Sweephy

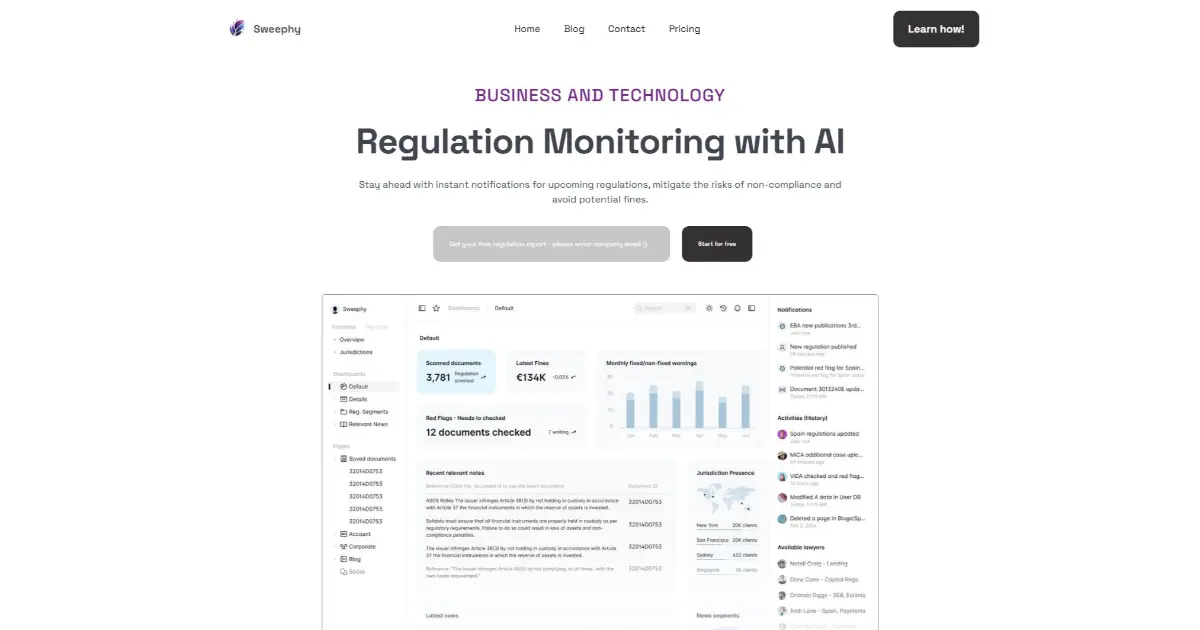

RecommendedSweephy is an AI-powered regulation monitoring platform that helps businesses stay compliant with real-time updates and tailored insights, ensuring they meet regulatory requirements efficiently.

January 3rd, 2026

About Sweephy

Sweephy is a platform designed to simplify regulatory compliance management, particularly for businesses in highly regulated sectors such as finance and healthcare.

By using AI to continuously track regulatory changes, Sweephy ensures that companies in regions like Europe, Turkey, and the UK can stay ahead of compliance requirements.

Sweephy offers real-time alerts, detailed scanning, and actionable insights, allowing businesses to respond quickly to regulatory changes. Through seamless API integrations with internal systems, Sweephy enhances decision-making and operational efficiency, making it an invaluable tool for mitigating compliance risks.

By utilizing Sweephy, businesses can enhance their compliance management processes, automate regulatory tracking, and gain industry-specific insights—all while reducing the risk of non-compliance and improving operational efficiency.

Pricing:

Free Plan: €0 — Initial scanning, 1 jurisdiction, 1 user.

Basic Plan: €500/month — Up to 3 jurisdictions, calendar integration, AI assistant.

Essentials Plan: €1450/month — Full EU coverage, reports, API integrations, document scanning.

Enterprise Plan: Contact for pricing — Custom solutions, private server setup, non-EU jurisdictions.

By using AI to continuously track regulatory changes, Sweephy ensures that companies in regions like Europe, Turkey, and the UK can stay ahead of compliance requirements.

Sweephy offers real-time alerts, detailed scanning, and actionable insights, allowing businesses to respond quickly to regulatory changes. Through seamless API integrations with internal systems, Sweephy enhances decision-making and operational efficiency, making it an invaluable tool for mitigating compliance risks.

By utilizing Sweephy, businesses can enhance their compliance management processes, automate regulatory tracking, and gain industry-specific insights—all while reducing the risk of non-compliance and improving operational efficiency.

Pricing:

Free Plan: €0 — Initial scanning, 1 jurisdiction, 1 user.

Basic Plan: €500/month — Up to 3 jurisdictions, calendar integration, AI assistant.

Essentials Plan: €1450/month — Full EU coverage, reports, API integrations, document scanning.

Enterprise Plan: Contact for pricing — Custom solutions, private server setup, non-EU jurisdictions.

Key Features

- Continuous Monitoring: AI-powered platform that monitors regulatory changes in real-time.

- Region-Specific Coverage: Tailored compliance coverage for the EU, UK, and Turkey, with plans for global expansion.

- Custom Alerts & Notifications: Receive instant updates and notifications about relevant regulatory changes.

- API Integrations: Easily integrates with internal systems to improve workflow and data management.

- Industry-Specific Insights: Get AI-driven, actionable insights tailored to your business needs and compliance risks.

- Compliance Calendar & Document Library: Track deadlines and store important compliance documents.

- Custom Solutions: Flexible support for custom solutions and private server setups.

Use Cases

- Regulatory Compliance for Financial Services: Automate compliance monitoring for FinTech companies and financial institutions.

- Risk Scoring for Small Banks: Leverage Sweephy’s risk scoring to track and assess compliance levels for small banks.

- Market Compliance for Traders: Analyze trade regulations and stay compliant with up-to-date insights for stock traders.

- Automated Data Collection & Reporting: Streamline data collection and reporting for regulatory audits and compliance assessments.

Loading reviews...